san francisco sales tax rate breakdown

The San Francisco sales tax rate is. Within South San Francisco there are around 2 zip codes with the most populous zip code being 94080.

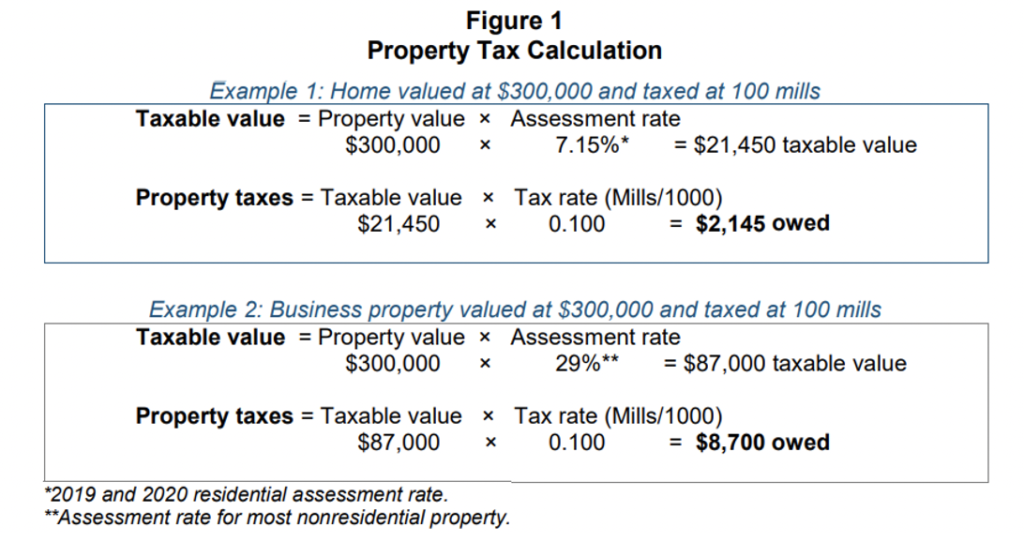

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

San francisco sales tax rate breakdown.

. 2020 rates included for use while preparing your income tax deduction. Californias base sales tax is 725 highest in the. The homeownership rate in san francisco ca is 371 which is lower than the national average of 641.

The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

A full list of locations can be found below. Cities with an asterisk may fall within multiple. Therefore you will not be responsible for paying it.

South San Francisco is located within San Mateo County California. The transient occupancy tax is also known as the hotel tax. You can print a 9875 sales tax table here.

The timezone for San Francisco California is currently Pacific Daylight Time PDT where the offset to Greenwich Mean Time GMT is -0700. This includes the sales tax rates on the state county city and special levels. The California sales tax rate is currently.

File Monthly Transient Occupancy Tax Return. The average cumulative sales tax rate in South San Francisco California is 988. The latest sales tax rate for San Francisco CA.

This rate includes any state county city and local sales taxes. Look up the current sales and use tax rate by address. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

The latest sales tax rate for San Francisco County CA. The December 2020 total local sales tax rate was 8500. Integrate Vertex seamlessly to the systems you already use.

San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. The San Francisco County sales tax rate is. Limited to 15 per year on the minimum base tax 30 per year on.

The minimum combined 2022 sales tax rate for San Francisco California is. The current total local sales tax rate in san francisco ca is 8625. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

The County sales tax rate is. 2020 rates included for use while preparing your income tax deduction. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

For tax rates in other cities see. This is the total of state county and city sales tax rates. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes. District tax areas consist of both counties and cities. This rate includes any state county city and local sales taxes.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. Sales Tax Breakdown For San. A base sales and use tax rate of 725 percent is applied statewide.

The December 2020 total local sales tax rate was 8500. To review the rules in California visit our state-by-state guide. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City.

The San Francisco County Sales Tax is collected by the merchant on all. As far as sales tax goes the zip code with the highest sales tax is 94128 and the zip code with the lowest sales tax is 94102. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

There may also be more than one district tax in effect in a specific location.

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How Much Is A 160 000 Year Salary After Taxes In California Quora

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax How To Calculate Local Considerations

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Catering Invoice Template 8 Templates To Set Catering Services Professionally Template Sumo

California S Progressive Tax System Proved Its Worth During The Pandemic Calmatters

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Ca Owner Sales Tax Registration License Fees Tesla Motors Club

How Good Is A Salary Of 85 000 To 90 000 In Canada Quora

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

25 Free Service Invoice Templates Billing In Word And Excel

California Taxes A Guide To The California State Tax Rates

Property Taxes Department Of Tax And Collections County Of Santa Clara

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

Ca Owner Sales Tax Registration License Fees Tesla Motors Club