how much tax is taken out of my first paycheck

And if you take out a significant amount it could bump you into a higher tax bracket. So if you took 20000 from your 401k and that puts you in the 22 tax bracket you may only get about 1200013000 depending on state income tax when all is said and done.

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

First use the withholding calculator to fill out Form W-4 so you dont get a refund or owe any taxes.

. For example a married couple with a combined income of more than 32000 may have to pay income tax on up to 50 of their Social Security benefits. Higher earners may have to pay income tax on up to 85 of their benefits. But the deduction must be taken from your gross income in determining your adjusted gross income.

Next youll want to adjust line 4c called Extra withholding which adds additional withholding to each paycheck you receive. If you get confused when completing your W-4 the IRS provides a free withholding calculator to help you determine the amount of money that should be taken out of your paycheck for income tax. To figure out how much you should add first think about how much of a refund youd like to see after taxes.

Effective Social Security tax rate just 29. You may also have to pay state income taxes on your Social Security benefits. This can also be the opportunity to do a paycheck checkup and adjust tax withholding if you didnt have enough taken out in the previous tax year.

If youre self-employed though the form you. Self-employed individuals If you are self-employed you are responsible for paying both the employers and. This is similar to the way employees are treated under the tax laws because the employers share of the Social Security tax is not considered wages to the employee.

Second you can deduct half of your Social Security tax on IRS Form 1040.

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

My First Job Or Part Time Work Department Of Taxation

How To Read Your Paycheck Arkansas Next

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding What S On Your Paycheck Xcelhr

When Was The Last Time You Looked At Your Pay Stub Direct Deposit Is An Amazing Thing Unfortunately It A Make Money Today How To Get Money Way To Make Money

Understanding Your Paycheck Credit Com

Themint Org Tips For Teens Decoding Your Paycheck

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Free Online Paycheck Calculator Calculate Take Home Pay 2022

7 Paycheck Laws Your Boss Could Be Breaking Fortune

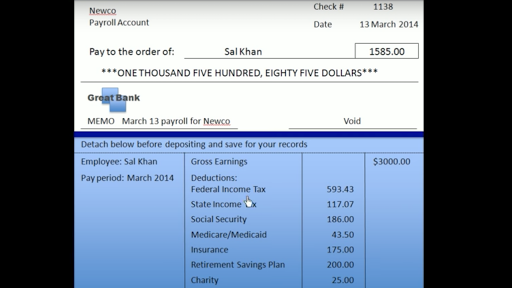

Different Types Of Payroll Deductions Gusto

Tax Information Career Training Usa Interexchange

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time